Your move, Fed

September 13, 2024

R. Gardner Sherrill MBA, CFP

connect with us

®

Personalized Financial Planning

For a confident retirement

Guiding Your Retirement Journey with Integrity & expertise

investing

post categories

economy

Why are we having volatility

Markets tumbled recently, giving their worst performance of 2024.1

And then promptly rallied again.

If you’ve been reading my recent emails, you’re probably not surprised.

Let’s talk about what’s going on.

What’s driving the volatility?

Profit-taking, for one.

Markets notched big gains in August, and traders decided to cash in some profits, which drove prices lower.2

Economic concerns are also in focus again.

The latest jobs report showed that the labor market is slowing down, as feared.

August data showed that jobs grew by a lukewarm 142,000, missing expectations.3

Data for prior months were also revised downward, giving July the lowest job creation number since December 2020.

Markets dropped in response to the data, largely out of worries about growth.

This behavior is the flipside of the trend we’ve seen repeatedly this year – where markets reacted positively to “bad” news because traders hoped it would boost the case for a cut in interest rates by the Federal Reserve.

Now, bad news is bad news again. Unless it’s good news.

It’s about as clear as mud.

We can expect this kind of vacillation between optimism and worry to continue.

What happens next?

Markets have had an overall strong run this year through the end of August.4

Now, we may be entering a chopp(ier) season for markets.

We have a lot of uncertainty on the horizon: economic news, Fed moves, a presidential election, and geopolitical issues that oscillate between heating up and cooling off.

It wouldn’t be surprising at all to see more volatility or a bigger correction as investors digest Fed policy and economic data.

However, the fundamentals still support growth.

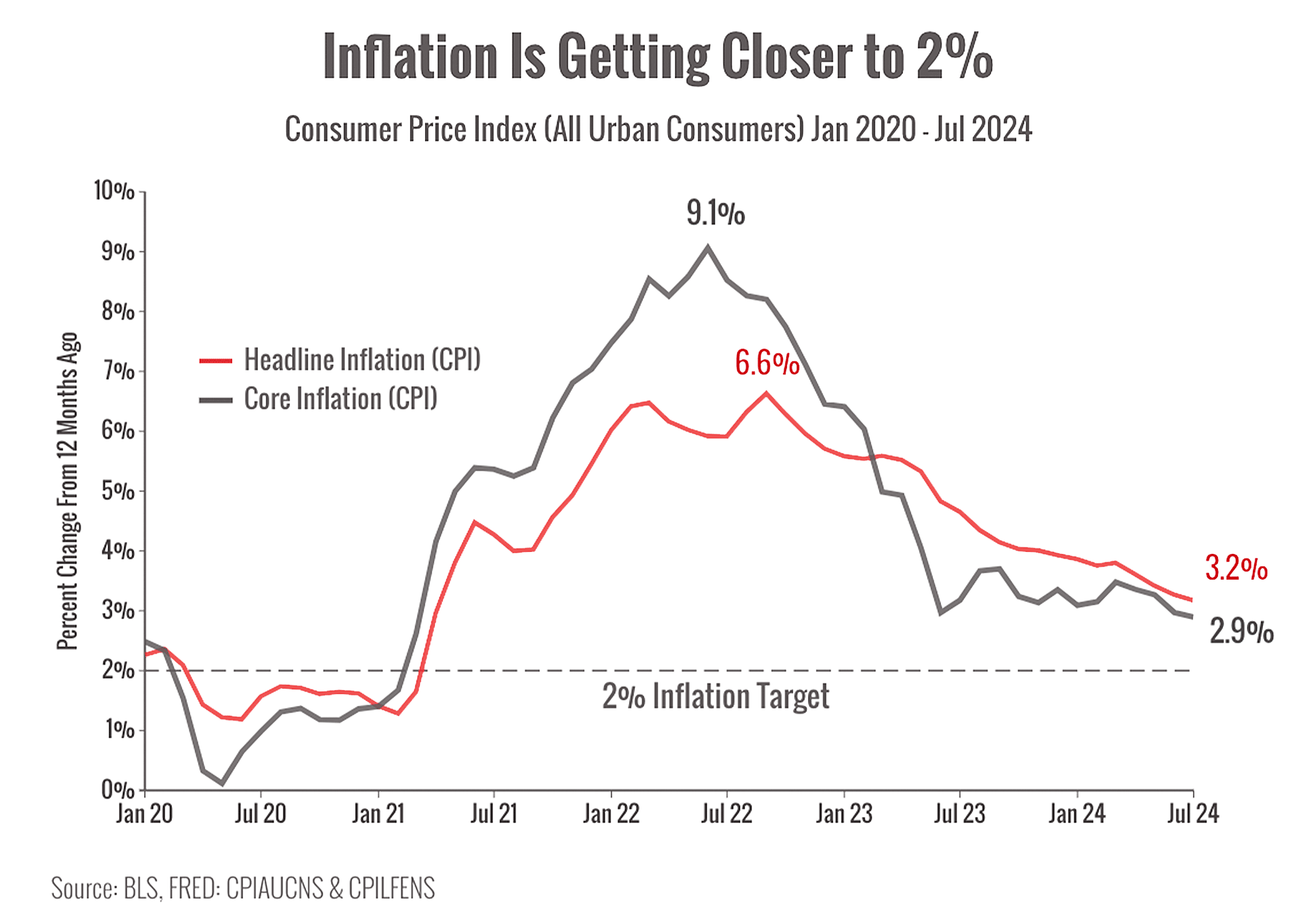

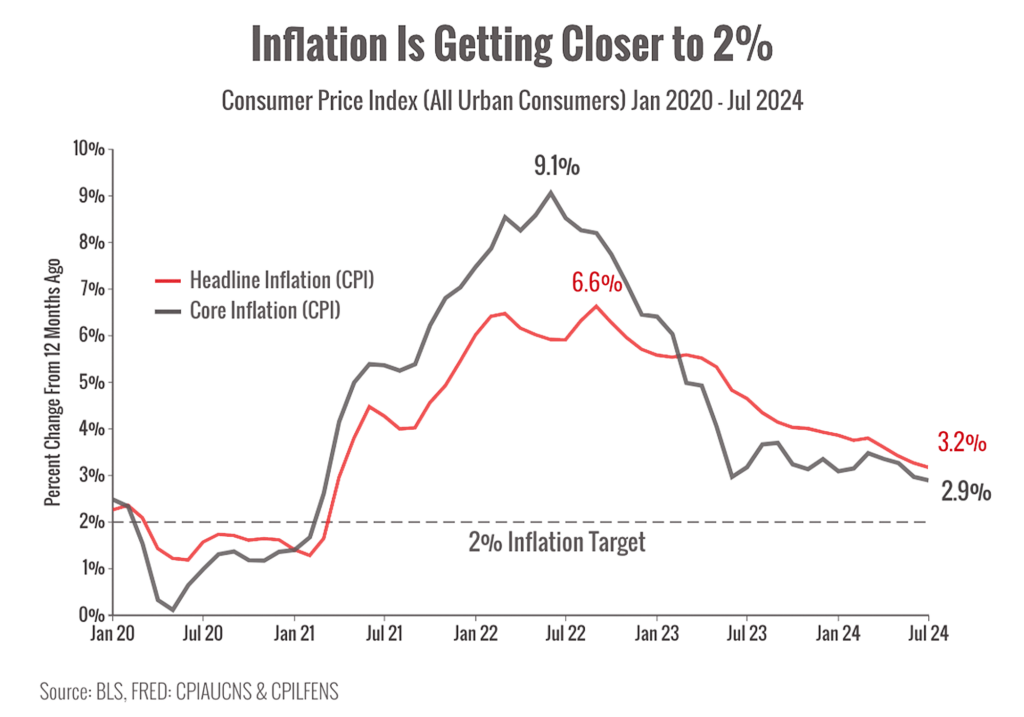

Inflation is heading lower toward the 2% goal.5

Economic growth may be cooling but is still expected to be strong this year.6

It’s always tempting to tactically sell and wait out rocky markets.

The problem is that it leaves you on the sidelines when markets move again.

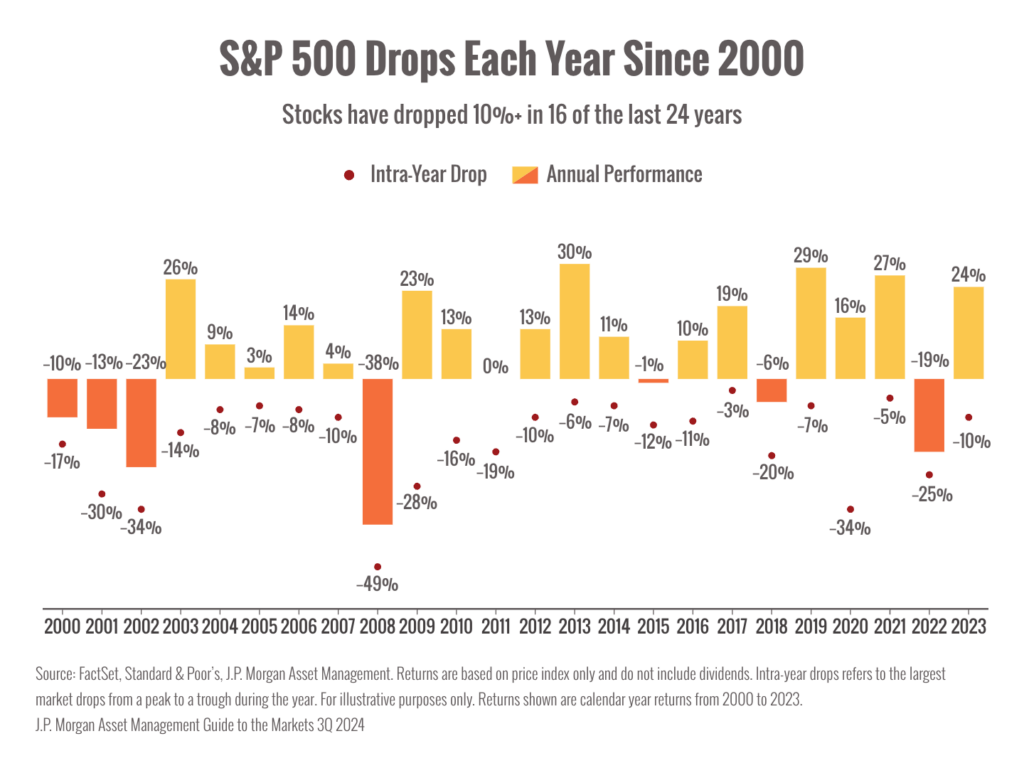

The chart below shows significant market drops since 2000.

You can see that corrections happen pretty regularly. Even in positive years.

I wish I could predict when markets would drop and when they’d pick back up again.

But no one can.

We build strategies based on our own goals and harness the market to put our portfolios to work.

We make careful adjustments and tactical shifts when needed.

But we don’t let short-term market moves throw us off course.

My team and I are watching and will keep you up to date throughout what’s likely to be a rocky fall.

If you have any questions or concerns, hit “reply” and let me know. We’ll set up a time to chat.

P.S. Do you have any friends or loved ones who are worried about what their portfolios are doing?

I’ve found that questions about investing and retirement tend to bubble to the surface when markets get choppy and people get worried.

I always hold a few spots in my calendar for my clients’ friends and loved ones.

If you’ve got someone in your life who could use an objective opinion or some reassuring advice, please hit “reply” and let me know.

I can’t help everyone but I’ll give anyone you send me a listening ear and my honest advice. It’s part of my commitment to you.

Sources:

1. https://www.cnbc.com/2024/09/08/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/09/09/fed-jumbo-50-bps-rate-cut-should-not-raise-alarm-analyst-says.html

3. https://www.foxbusiness.com/economy/us-jobs-report-august-2024

4. https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes/

6. https://www.atlantafed.org/cqer/research/gdpnow

https://fred.stlouisfed.org/series/CPIAUCNS#0, https://fred.stlouisfed.org/series/CPILFENS#0, https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Personalized Financial Planning, for a a confident retirement, based in Bradenton, FL - Serving clients across the US | Guiding your retirement with integrity and expertise.

Quick Contact Info

2520 Manatee Avenue West

Suite 200

Bradenton, FL 34205

info@sherrillwealth.com

941-745-2201

Site Menu

Site Menu

Our Services

Retirement Planning

Investment Management

Social Security Timing

Retirement Income

Tax Planning

Insurance Optimization

Estate and Legacy Planning

Retirement Readiness Masterclass

TO TOP

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Advisor.

Information presented on this site is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any product or security.

Certified Financial Planner Board of Standards

Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification mark.

This communication is strictly intended for individuals residing in the United States.

© 2012-2024 Sherrill Wealth Management | Privacy Policy | site credits

© 2012-2024 Sherrill Wealth Management

PRIVACY POLICY | site credits