What happens next? (market rollercoaster)

August 25, 2024

R. Gardner Sherrill MBA, CFP

connect with us

®

Personalized Financial Planning

For a confident retirement

Guiding Your Retirement Journey with Integrity & expertise

investing

post categories

economy

It’s been a wild August for markets.

Recession fears kicked off the worst selloff since 2022 at the beginning of the month.

Then markets staged a choppy recovery, even notching the strongest week of the year along the way.1

That’s not so surprising.

It’s very common for a strong recovery to follow a selloff.

It’s one of the (many) boring reasons I recommend not abandoning an investing strategy when markets get jittery.

(If you ever feel tempted, please reach out so we can talk.)

I can’t predict the future, but I can show you what has historically happened and offer reassurance.

So, what could happen next for markets?

I expect more volatility ahead.

Despite renewed recession fears, fresh data seems to have eased investor anxiety and boosted hopes that a recession-free “soft landing” is still achievable.

That’s good news for markets, but there are plenty of risks to watch.

Let’s take a look.

What positive factors could push markets higher?

Inflation continues to head downward, which is good news for consumers and supports the case for interest rate cuts this year.2

Other economic data is also showing optimism.

Retail sales jumped unexpectedly, suggesting American consumers are doing better than expected.3

Since consumer spending accounts for about 70% of U.S. economic growth, it’s a big indicator of economic health.

Analysts currently expect the Federal Reserve to cut interest rates in September.4

Notes from the last Federal Open Market Committee meeting showed that policymakers are close to cutting rates, supporting hopes for a September cut.5

What negative factors could trigger a selloff?

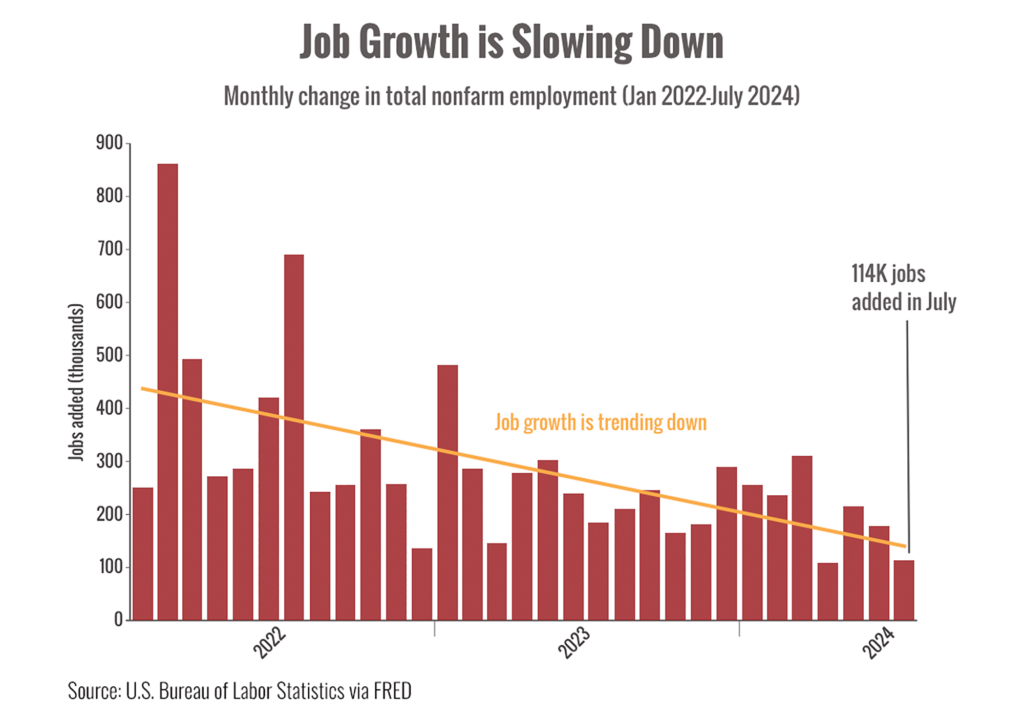

The labor market is showing cracks.

The unemployment rate ticked up in July to its highest level since October 2021, and job growth slowed more than expected.6

You can see in the chart above that job creation has been slowing down over the past two years.

That’s not entirely surprising since the labor market has been recovering from pandemic disruptions.

However, a recently released annual revision of job data showed that the economy added nearly 30% fewer jobs over the last 12 months than originally reported.7

If the labor market weakens and Americans start to worry about their financial situation, it could erode consumer confidence and spending later in the year.

The past few weeks have shown us how easy it is for investors to lose their optimism in a selloff…

And then quickly regain it in a recovery.

While markets tend to reflect the economy in the medium and long term, the opposing emotions of fear and greed tend to have greater influence in the short term.

We’re seeing a lot of reasons to be optimistic, but we’re also watching some clouds on the horizon.

Though it doesn’t seem likely that a recession is here or even around the corner, we’re monitoring the data closely and will be in touch as needed.

Have questions about what markets are doing? Hit “reply” and let me know.

P.S. Markets are likely to remain volatile in the coming weeks, especially given the focus on the economy, interest rates, and the election.

If you ever have questions about how the economy, markets, or politics could impact your portfolio or your income, please reach out.

My job is to answer questions and solve problems for you. Don’t ever hesitate to call.

Sources:

1. https://www.cnbc.com/2024/08/18/stock-market-today-live-updates.html

2. https://www.bls.gov/news.release/cpi.nr0.htm

3. https://www.cnbc.com/2024/08/15/retail-sales-july-2024-.html

4. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

5. https://www.cnbc.com/2024/08/21/fed-minutes-july-2024.html

Chart source: https://fred.stlouisfed.org/series/PAYEMS#0, trend line is linear

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Personalized Financial Planning, for a a confident retirement, based in Bradenton, FL - Serving clients across the US | Guiding your retirement with integrity and expertise.

Quick Contact Info

2520 Manatee Avenue West

Suite 200

Bradenton, FL 34205

info@sherrillwealth.com

941-745-2201

Site Menu

Site Menu

Our Services

Retirement Planning

Investment Management

Social Security Timing

Retirement Income

Tax Planning

Insurance Optimization

Estate and Legacy Planning

Retirement Readiness Masterclass

TO TOP

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Advisor.

Information presented on this site is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any product or security.

Certified Financial Planner Board of Standards

Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification mark.

This communication is strictly intended for individuals residing in the United States.

© 2012-2024 Sherrill Wealth Management | Privacy Policy | site credits

© 2012-2024 Sherrill Wealth Management

PRIVACY POLICY | site credits