The One-Time IRA to HSA Transfer: A Smart Financial Consideration

December 30, 2024

R. Gardner Sherrill MBA, CFP

connect with us

®

Personalized Financial Planning

For a confident retirement

Guiding Your Retirement Journey with Integrity & expertise

investing

post categories

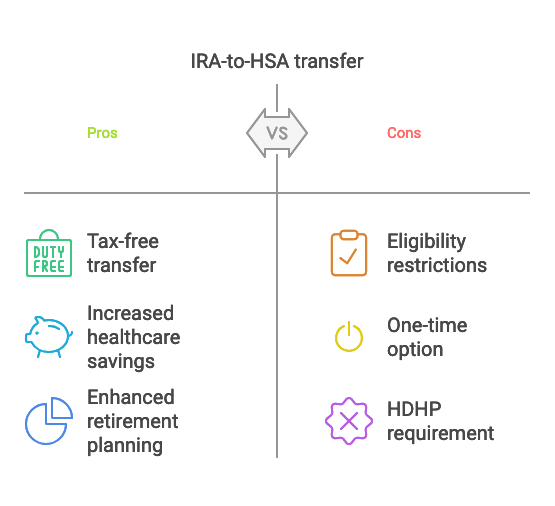

economy

The IRA-to-HSA transfer provides a unique opportunity to bolster healthcare savings while gaining tax advantages. This one-time option allows individuals to move funds from their Individual Retirement Account directly to a Health Savings Account, tax-free when executed correctly.

Eligibility Requirements

To qualify, you must:

- Be enrolled in a High Deductible Health Plan (HDHP)

- Have both an HSA and an IRA

- Not be enrolled in Medicare

- Maintain HDHP coverage for 13 months post-transfer

Contribution Limits (2025)

- Individual Coverage: $4,150

- Family Coverage: $8,550

Note: For any existing HSA contributions for the year, reduce the amount you can transfer.

Transfer Process

The transfer must be executed as a direct trustee-to-trustee transaction, a Qualified HSA Funding Distribution (QHSAFD). This method avoids taxes and penalties typically associated with early IRA withdrawals.

Your HSA provider will require completing an HSA One-Time IRA Rollover Request Form. Written certification to your trustee confirming the rollover contribution is also necessary.

Tax Implications

While the transfer itself is tax-free, several key considerations apply:

- The transferred amount counts toward your annual HSA contribution limit

- Unlike regular HSA contributions, this transfer isn’t tax-deductible

- Failing to maintain HDHP coverage for the required 13-month testing period triggers taxes and a 20% penalty

- Transferring from a Roth IRA typically isn’t advisable due to existing tax advantages

Strategic Benefits

This transfer offers unique advantages:

- Immediate access to funds for medical expenses without IRA withdrawal penalties

- Tax-free growth potential

- Flexibility in using funds for qualified medical expenses

- Triple tax advantage: tax-free contributions, growth, and qualified withdrawals

Medicare Considerations

Timing is crucial for those approaching Medicare eligibility:

- Complete the transfer at least 12 months before Medicare enrollment

- Consider the six-month lookback period for Medicare Part A

- Once enrolled in Medicare, transferred HSA funds can cover premiums, deductibles, and co-pays

Compliance Requirements

Maintain detailed records of the transfer and ensured continued HDHP coverage throughout the testing period. Please consult a tax professional for guidance specific to your situation, as this one-time opportunity requires careful planning to maximize its benefits.

Commonwealth Financial Network® and Sherrill Wealth Management do not provide legal or tax advice. You should consult a legal or tax professional regarding your individual situation.

Understanding the One-Time IRA-to-HSA Transfer: What You Need to Know

Imagine having a financial strategy that helps you save for healthcare costs and provides tax advantages during retirement. The one-time transfer from an Individual Retirement Account (IRA) to a Health Savings Account (HSA) offers just that. It permits individuals to enhance their medical funding while benefiting from significant tax breaks. Understanding the nuances of this transfer can be pivotal for effective financial management.

Navigating the rules of this unique transfer can be complex, from eligibility criteria and documentation to potential tax implications. Many individuals are unaware of the specific conditions that must be met to qualify for this transfer, nor do they grasp how the process can impact their overall savings strategy. Gaining clarity on these elements can lead to more informed decisions regarding healthcare financing in retirement.

This article will explore the eligibility requirements, the transfer process, and the tax implications of moving funds from an IRA to an HSA. By the end, you’ll understand how to successfully execute this transfer and uncover the strategic advantages of using HSAs to manage healthcare costs.

Eligibility Requirements

To qualify for an IRA-to-HSA transfer, you must meet specific conditions. You must be enrolled in a High Deductible Health Plan (HDHP). Also, you should not be ineligible for a Health Savings Account (HSA) for reasons such as being on Medicare and maintaining your eligibility for the HSA for at least 12 months after the transfer is crucial. If you don’t, you could face tax penalties. Additionally, you must have an HSA and an IRA unless your IRA is inherited. The amount you can transfer is capped. It can’t exceed your annual HSA contribution limit minus any previous HSA contributions for that year.

Who is eligible for the transfer?

The individual must meet several criteria to transfer from an IRA to an HSA. First, you need to be part of a qualified HDHP. The transfer amount is subject to the annual HSA contribution cap, which depends on your coverage type. If you’ve already contributed to your HSA this year, subtract those contributions from your yearly cap to determine how much can be transferred. The funds must move directly from your IRA to your HSA. Finally, you must keep your HDHP coverage for 13 months post-transfer to avoid penalties.

Specific criteria must be met to be eligible for a one-time transfer from an Individual Retirement Account (IRA) to a Health Savings Account (HSA). Here are the key requirements:

- Enrollment in a Qualified HDHP: To be eligible, you must be enrolled in a high-deductible health plan (HDHP).

- Contribution Limits: The maximum amount you can transfer aligns with your annual HSA contribution limit. This limit depends on your coverage type—self-only or family—and age.

- Existing Contributions: If you’ve already contributed to your HSA for the year, subtract these amounts from your annual limit to find the allowable transfer amount.

- Direct Transfer: The transfer should go directly from your IRA to your HSA. The owner of both accounts must be the same.

- Testing Period: After the transfer, you must stay enrolled in the HDHP for 13 consecutive months. This avoids penalties and taxes on the transferred funds.

Here’s a quick checklist for eligibility:

- Enrolled in a qualified HDHP

- Meet the annual HSA contribution cap

- Transfer directly from IRA to HSA

- Maintain HDHP coverage for 13 months

Following these rules ensures a smooth and penalty-free transfer.

Income limits and other considerations

If you’re considering a one-time transfer from an IRA to an HSA, you must understand the income limits and other considerations related to this move. First and foremost, this transfer must align with annual contribution limits. For 2025, individuals can contribute up to $4,150, while families have a limit of $8,550.

| Contribution Limits (2025) | Individual | Family |

| Maximum Contribution | $4,150 | $8,550 |

This transfer is considered a Qualified HSA Funding Distribution (QHSAFD). It’s crucial to remain eligible for a High-Deductible Health Plan (HDHP) for at least 12 months after the transfer. Failing this, you could face income tax fees and a 10% withdrawal penalty.

Additional considerations include understanding that any IRA transfer counts towards your annual HSA contribution limit, even if it occurs between January 1 and April 15 of the following year. Staying aware of these rules can help you maximize your tax benefits while avoiding unexpected penalties. Always consult a tax advisor for personalized advice.

The Transfer Process

Transferring funds from an IRA to an HSA is a unique opportunity known as a Qualified HSA Funding Distribution (QHSAFD). This process allows you to move money from your IRA to your HSA once it is tax-free. There are specific rules to ensure the transfer goes smoothly without penalties.

What is a Qualified HSA Funding Distribution (QHSAFD)?

A QHSAFD is a one-time, tax-free transfer from your IRA to your HSA. It must be a direct trustee-to-trustee transfer to avoid taxes and penalties. You can only transfer up to the remaining amount allowed for contributions that year. If you’ve already contributed some to your HSA, you can only transfer enough to reach the annual limit. Unlike regular IRA distributions, there’s no 10% early withdrawal penalty with a QHSAFD. However, you must stay in a qualifying high-deductible health plan (HDHP) for 12 months after the transfer. Failing to do so can lead to taxes and penalties.

Steps to Execute an IRA-to-HSA Transfer

To execute this transfer, follow a few key steps:

- Ensure Eligible Enrollment: Ensure you’re enrolled in a qualifying HDHP and not on Medicare.

- Initiate with the IRA Custodian: Start by notifying your IRA custodian.

- Direct Trustee-to-Trustee Transfer: The transfer must be direct, with funds moving directly from the IRA to the HSA.

- Adhere to Contribution Limits: The total amount transferred and other HSA contributions must not exceed the annual contribution limit.

Maintaining enrollment in an HDHP for 13 months post-transfer is crucial to avoid taxes and penalties.

Necessary Documentation and Forms Required

To transfer, complete an HSA One-Time IRA Rollover Request Form from your HSA provider. You must also certify in writing to your trustee that you’re making a rollover contribution. As a trustee-to-trustee transfer, this transaction will count toward your annual HSA contribution limit. Remember, you’re only allowed one tax-free IRA to HSA transfer in your lifetime, so handle it carefully!

Tax Implications

A one-time transfer from an IRA to an HSA is known as a Qualified HSA Funding Distribution (QHFD). This process is tax-free when done correctly and allows funds to move without any tax burden. However, the transferred amount counts towards your HSA’s annual contribution limit. Unlike regular tax-deductible HSA contributions, a QHFD does not provide a tax deduction. Furthermore, account holders must keep a high-deductible health plan (HDHP) for 12 months after the transfer. Not doing so may lead to income taxes and penalties on the funds. Lastly, transferring funds from a Roth IRA is typically not wise since Roth withdrawals are often tax-free.

Understanding tax liabilities during the transfer

To qualify as tax-free, the transfer should be a trustee-to-trustee move. Remember, the transferred amount goes towards your annual HSA contribution limit. Exceeding this, combined with other contributions, could cause issues. You must remain in an HDHP for at least 13 months post-transfer to evade taxes and a 20% penalty. If you lose your HDHP eligibility within 12 months, the funds become taxable and face an extra 10% tax unless exceptions like death or disability apply. Always consult a tax professional, as there are no unique forms to report this.

How the transfer affects retirement savings

Transferring from a traditional IRA to an HSA can protect your retirement savings. HSA funds used for qualified medical expenses are tax-free. Changing to a non-HDHP involves a 12-month testing period. Failure to maintain eligibility results in taxes and penalties. Since this is a once-in-a-lifetime chance, plan strategically to enhance retirement savings. Avoid transferring Roth IRAs as it might not make financial sense due to their tax-free withdrawal benefits.

Reporting the transfer for tax purposes

When transferring from an IRA to an HSA, the amount is not taxable and can’t be deducted in tax filings. Changing to an ineligible health plan within the testing period means reporting the amount as income and potentially facing a 10% penalty. Certify to the trustee in writing about the rollover; this certification is final. Note that this reduces the HSA contribution cap for the year. Claim any tax benefits on your return since no unique 1099-R code exists for this process.

| Key Point | Details |

| Tax-Deductibility | QHFD is not tax-deductible, unlike regular HSA contributions. |

| High-Deductible Health Plan (HDHP) | Needed for 12 months post-transfer to avoid taxes and penalties. |

| Roth IRAs | Generally, not advisable for transfer due to typical tax-free withdrawals. |

| Testing Period | Must remain HSA-eligible for 12 months or face possible taxes and penalties. |

| Reporting Requirements | No special tax form: certification to trustee is required. |

Comparing HSAs and FSAs

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) help manage medical expenses. However, you can’t contribute to simultaneously if you want HSA eligibility. HSAs need a high-deductible health plan (HDHP), while FSAs use any health insurance plan. HSAs and FSAs provide tax savings but differ in their features and benefits.

Key differences between HSAs and FSAs

- Contribution Rules: You can’t contribute to simultaneously if you want your HSA to stay valid. FSAs work with any health insurance plan, while HSAs need an HDHP.

- Rollover: HSAs let you roll over funds year after year. FSAs usually follow a “use-it-or-lose-it” rule.

- Employer Contributions: Employers might match employee contributions to HSAs. FSAs give you access to the full elected amount at the start of the year, while you need to fund HSAs over time.

- Growth Potential: Funds in HSAs can grow tax-free, especially if they earn interest. FSAs usually don’t offer this growth feature.

Here’s a simple table to compare:

| Feature | HSA | FSA |

| Eligibility | Needs HDHP | Any health plan |

| Fund Rollover | Yes | No |

| Employer Matching | Possible | Not typical |

| Tax-advantaged Growth | Yes | No |

Advantages of using HSAs for medical expenses

- Tax Benefits: HSAs offer tax-free contributions, growth, and withdrawals for medical expenses. This results in considerable tax savings.

- Rollover Funds: Unlike FSAs, HSAs let you roll over unused funds yearly. This helps build up savings for future medical costs.

- IRA to HSA Transfer: You can do a one-time transfer from an Individual Retirement Account (IRA) to boost your HSA without immediate tax charges.

- Out-of-Pocket Healthcare Costs: An HSA helps manage costs tied to high-deductible health plans. Since funds don’t expire, you can save for future expenses.

HSAs are a smart way to plan for health care expenses and take advantage of government tax benefits.

Annual Rollover Limits

Rolling over funds from an Individual Retirement Account (IRA) to a Health Savings Account (HSA) can be a smart financial move. However, it comes with some essential rules. The maximum amount you can roll over is tied to the annual HSA contribution limit. For example, in 2020, the limit was $3,550 for individuals and $7,100 for family coverage. If you were 55 or older, you could make an extra $1,000 catch-up contribution. Remember that this rollover counts towards your HSA contribution limit for the year. While such rollovers are not tax-deductible, they don’t affect your overall tax situation. Staying enrolled in a qualifying high-deductible health plan for 12 months after the transfer can help avoid taxes and penalties.

Implications of Exceeding Contribution Limits

Exceeding the annual HSA contribution limit can lead to penalties. The amount you transfer from an IRA and other contributions must not exceed the current year’s HSA limit. If you go over, penalties and taxes may apply. An important rule is that after an IRA-to-HSA transfer, you must remain eligible for 12 months. Otherwise, you could face taxes and penalties. It’s also essential to consider any contributions you or your employer made during the year. These will impact your allowable Qualified HSA Funding Distribution (QHSAFD) from an IRA. Always check your contribution levels to avoid extra costs.

Strategic Advantages of HSAs

Health Savings Accounts (HSAs) offer a significant tax advantage. They are triple tax-free. This means that contributions, growth, and withdrawals for medical expenses are all tax-exempt. Unlike flexible spending accounts, HSA funds roll over each year. This allows for savings to accumulate for future health needs. A one-time transfer from an individual retirement account (IRA) to an HSA can further enhance these benefits. This direct transfer helps avoid the income tax and penalties that typically apply to IRA withdrawals. Especially for those aged 55 or older, HSAs offer additional tax advantages with higher contribution limits. However, one must be enrolled in a high-deductible health plan (HDHP) to benefit. This makes the connection between managing health costs and increasing savings even more advantageous.

Using HSAs to manage healthcare costs

HSAs offer an affordable way to manage medical expenses. With tax-free withdrawals, these accounts make financial sense for qualified health costs. Contributions to HSAs are often exempt from federal and most state taxes. This can lead to substantial savings. Unlike some accounts, HSAs enable unspent funds to roll over, building up savings over time. Making a one-time transfer from an IRA to an HSA can significantly boost HSA balances. This transfer means more funds are available for medical expenses without extra tax payments. Annual contribution limits set by the IRS guide how much individuals can save in these tax-advantaged accounts. This helps ensure that account holders maximize their savings potential each year.

Tax benefits associated with HSAs

HSAs provide distinct tax benefits by allowing contributions to lower taxable income. This account type enjoys a triple tax-free status: no taxes on contributions, growth, or qualified withdrawals. A one-time, tax-free IRA to HSA transfer, known as a qualified HSA funding distribution, allows payment for medical expenses without taxes or penalties. However, the amount transferred is limited to the year’s HSA contribution limit. Therefore, careful planning is necessary to avoid exceeding this limit, resulting in taxes and penalties. In summary, HSAs offer a strategic way to manage healthcare costs with the added benefit of tax savings.

Considerations for Medicare Enrollees

When approaching Medicare enrollment, planning your financial moves wisely is essential. If you are considering transferring funds from an Individual Retirement Account (IRA) to a Health Savings Account (HSA), timing is everything. The transfer can help fund health care expenses that are tax-advantaged. However, if you do this less than 12 months before turning 65, your HSA contributions could face disqualification. This is because Medicare enrollment typically starts the first day of the month you turn 65.

Moreover, if you delay enrolling in Medicare past 65 due to other coverage, consider the six-month lookback for Medicare Part A. This can affect the timing of any IRA-to-HSA rollovers you plan. Missing the direct rollover option means you may have to take a taxable IRA distribution.

Impact of Transfer on Medicare Participants

Transferring from an IRA to an HSA within a year of enrolling in Medicare disqualifies your contributions. The testing period is crucial here. To avoid penalties, you must stay enrolled in a high-deductible health plan (HDHP) for 12 months post-rollover. Changing to an ineligible plan during this time means the transferred amount could count as income on your tax return.

The penalty for early withdrawal from the IRA can be 10% if you fail to remain eligible through the testing period. Be aware of Medicare Part A lookbacks, as these might also affect your contributions to an HSA.

Additional Rules for Those on Medicare

Once you’re nearing Medicare eligibility, perform an IRA-to-HSA rollover over 12 months before your Medicare start date. This will help maintain eligibility for your contributions. Enrollment in Medicare less than a year post-transfer can invalidate these contributions.

After rolling funds from an IRA to an HSA, stay on a high-deductible health plan (HDHP) until the end of the 12th month following the rollover year. Failing to do so can cause significant tax and withdrawal issues. Yet, once you’re on Medicare, you can use HSA funds tax-free for premiums, deductibles, and co-pays.

Types of IRAs and Their Implications

Individual Retirement Accounts (IRAs) come in several types, each with distinct features and tax benefits. Traditional IRAs, Roth IRAs, inactive SEP IRAs, and inactive SIMPLE IRAs can be eligible for a one-time tax-free rollover to a Health Savings Account (HSA). This unique transfer, a Qualified HSA Funding Distribution (QHSAFD), allows immediate access to medical expense funds, offering tax-free withdrawals. This can lead to significant tax savings, especially for those with high healthcare expenses. Nondeductible IRA contributions, however, cannot be included in such a rollover and will remain in the IRA.

Differences between Roth and traditional IRAs

Traditional IRAs and Roth IRAs differ mainly in taxation timing. Contributions to a traditional IRA are generally made with pre-tax dollars, allowing the funds to grow tax deferred. However, withdrawals are taxed as income, and if taken before 59½, may incur a 10% penalty, except in certain situations. On the other hand, Roth IRA contributions come from after-tax income. While not tax-deductible, these contributions—and their earnings—can be withdrawn tax-free in retirement, provided some conditions are met. For HSA transfers, traditional IRAs are typically better due to their tax-deferred nature, making these rollovers more tax-advantageous compared to Roth IRAs, which have already been taxed.

How each type affects the one-time transfer

The one-time transfer of IRA assets to an HSA has specific rules. The amount transferred is capped by the maximum annual HSA contribution limit for the year. If you have already made contributions to your HSA in that year, those amounts will lower the allowed transfer limit dollar-for-dollar. This kind of transfer can only happen once in a lifetime, except if you switch from self-only HDHP coverage to family coverage within the same year, which permits another transfer. To qualify for this transfer, you must be an HSA-eligible individual, which means enrolling in a High Deductible Health Plan (HDHP) and not having other disqualifying factors. After completing the transfer, you must remain eligible for at least 12 months to avoid tax and penalties.

Compliance Guidelines

Transferring funds from an IRA to an HSA can offer significant tax advantages. This one-time transfer allows account holders to move money without facing income taxes or withdrawal penalties. However, compliance with IRS guidelines is crucial. The key is to remain enrolled in a high-deductible health plan (HDHP) for 12 months after the transfer to avoid any taxes.

Ensuring adherence to IRS guidelines

To correctly complete an IRA-to-HSA transfer, you must stay eligible for HSA contributions for 12 months afterward. This means staying under an HDHP plan during the testing period. Not meeting these conditions could result in the amount being treated as taxable income, plus a 10% penalty. Also, if you plan to enroll in Medicare, make your transfer more than 12 months ahead of time to avoid issues. The transfer is a Qualified HSA Funding Distribution (QHFD), which excludes the transferred amount from taxable income but doesn’t allow it as a tax deduction. Proper compliance helps avoid unexpected tax bills.

Personalized Financial Planning, for a a confident retirement, based in Bradenton, FL - Serving clients across the US | Guiding your retirement with integrity and expertise.

Quick Contact Info

2520 Manatee Avenue West

Suite 200

Bradenton, FL 34205

info@sherrillwealth.com

941-745-2201

Site Menu

Site Menu

Our Services

Retirement Planning

Investment Management

Social Security Timing

Retirement Income

Tax Planning

Insurance Optimization

Estate and Legacy Planning

Retirement Readiness Masterclass

TO TOP

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Advisor.

Information presented on this site is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any product or security.

Certified Financial Planner Board of Standards

Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification mark.

This communication is strictly intended for individuals residing in the United States.

© 2012-2024 Sherrill Wealth Management | Privacy Policy | site credits

© 2012-2024 Sherrill Wealth Management

PRIVACY POLICY | site credits