Prioritizing Your Retirement Expenses

April 25, 2025

R. Gardner Sherrill MBA, CFP

connect with us

®

Personalized Financial Planning

For a confident retirement

Guiding Your Retirement Journey with Integrity & expertise

investing

post categories

economy

A Guide to Essential versus Discretionary Spending

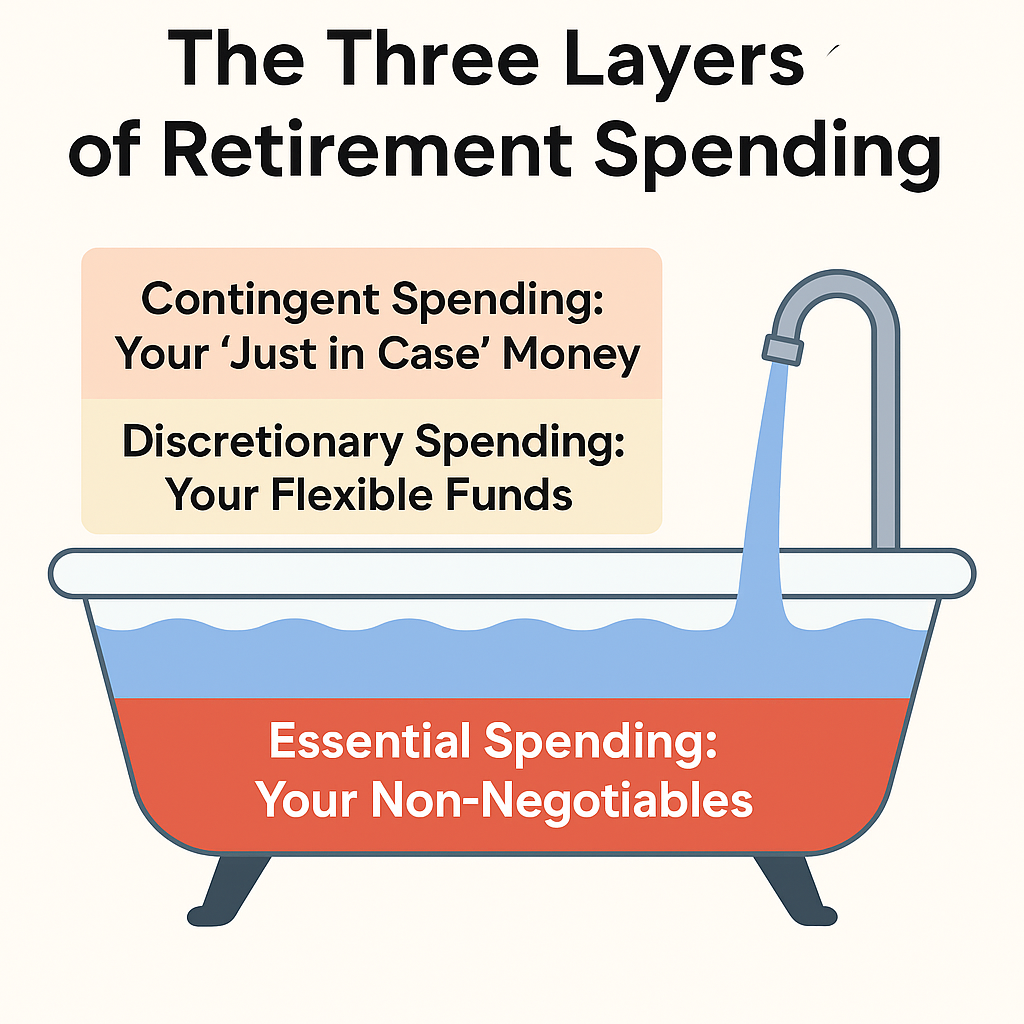

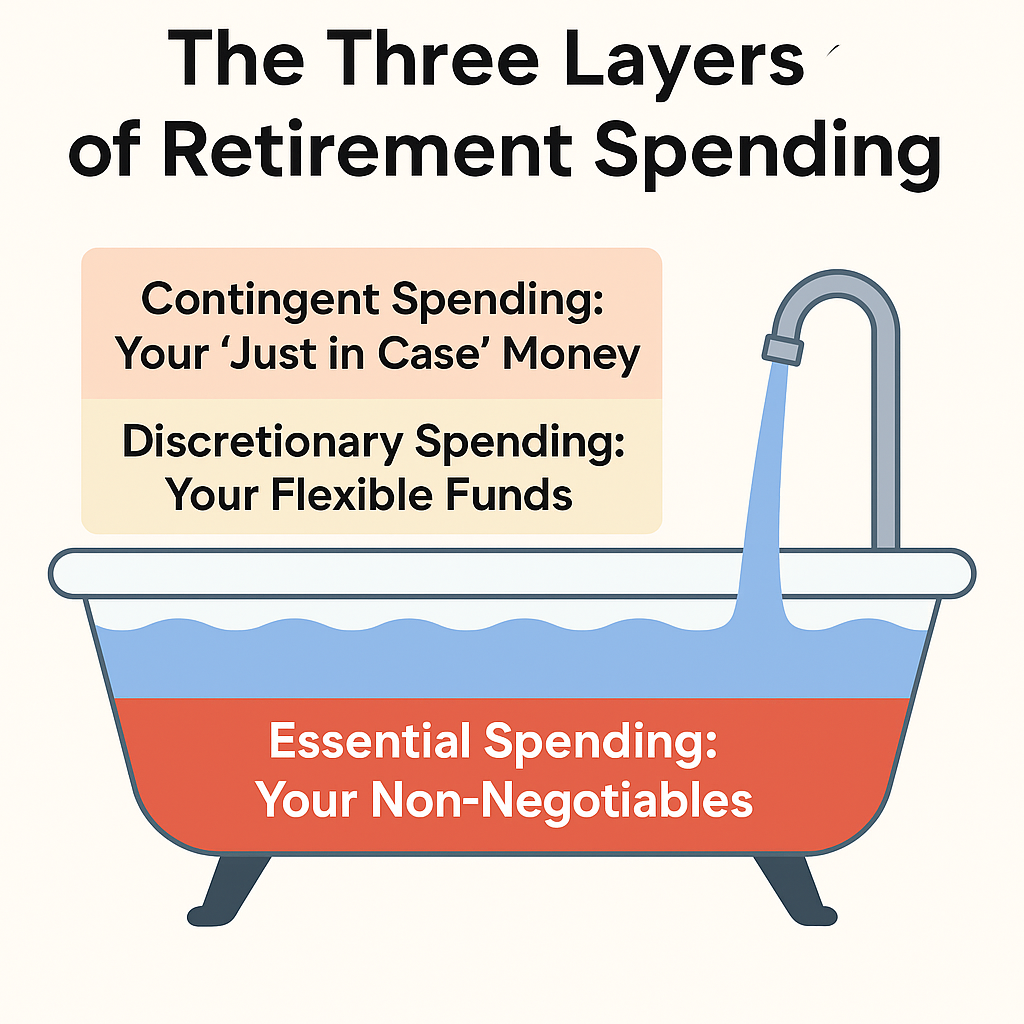

Picture your retirement spending as filling a bathtub. The most crucial expenses lie at the bottom, while the “nice-to-haves” float toward the top. But how do you determine what goes where? And more importantly, how do you ensure you’ll have enough water (money) to fill that tub?

Many retirees fall into a common trap: they choose a single target number for their annual retirement income and call it a day. However, this oversimplified approach misses something vital. Your retirement spending isn’t just one big number – it’s a complex mix of different needs and wants, each carrying varying weights and levels of flexibility.

The Three Layers of Retirement Spending

Let’s categorize your retirement expenses into three key areas:

1. Essential Spending: Your Non-Negotiables

These are the expenses you simply can’t—or won’t—live without: housing payments, groceries, utilities, and healthcare. They form the foundation of your retirement lifestyle and should typically be funded by your most reliable income sources.

2. Discretionary Spending: Your Flexible Funds

This is the spending that enhances your lifestyle but could be reduced if necessary. Travel, dining out, hobbies, and entertainment fall into this category. While these expenses make retirement more enjoyable, they are the ones you could adjust during market downturns.

3. Contingent Spending: Your “Just in Case” Money

These unexpected but important expenses can arise: a new roof, major car repairs, or medical emergencies. While they’re difficult to predict, it’s crucial to plan for them.

Your essential may be someone else’s discretionary.

Here’s where retirement planning gets personal: what’s essential to you might be discretionary to someone else, and vice versa. A country club membership may seem like a luxury to many, but for someone whose social life and exercise routine revolves around golf, it might feel essential.

The key isn’t to judge these choices but to be honest about your priorities and plan accordingly. Think of your expenses on a spectrum, from “absolutely necessary” to “nice to have.” This clarity will help you:

- Create a more accurate retirement budget

- Determine which expenses you could cut if necessary.

- Align your spending needs with suitable income sources

Matching Income Sources to Spending Types

Your retirement income usually comes from three sources:

- Reliable Income (Social Security, pensions, annuities)

- Investment Portfolio Income (stocks, bonds, mutual funds)

- Reserve assets (emergency funds, home equity)

Ideally, you want your essential expenses covered by your reliable income sources. This creates a strong foundation for your retirement plan, allowing for more flexible spending supported by variable income sources.

The Retirement Income Balancing Act

Remember that bathtub analogy? Your dependable income sources should fill the bottom of the tub first, covering your essential expenses. Then, investment income can fill the middle, supporting your discretionary spending. Reserve assets sit ready to address unexpected contingent expenses.

This approach helps to answer crucial questions, such as:

- How much of your spending requires guaranteed income?

- What level of investment risk can you accept?

- What size should your emergency fund be?

Adjusting to Life’s Changes

Your spending priorities will likely shift throughout retirement. What seems essential at 65 might become less important at 80, and new priorities may emerge. Regular reviews of your spending categories help to ensure that your financial plan remains aligned with your evolving needs.

Taking Action

Begin by listing all your anticipated retirement expenses. Then, truthfully categorize them as essential, discretionary, or contingent. Consider taking the Retirement Income Style Assessment (RISA) to enhance your understanding of your risk tolerance and preferred approach to retirement income planning.

Remember, the goal isn’t perfect precision in categorizing every expense. Instead, focus on creating a flexible framework that helps you fund your retirement priorities while maintaining financial security. Your retirement should be both enjoyable and sustainable—finding the right balance between these elements is key to success.

Personalized Financial Planning, for a a confident retirement, based in Bradenton, FL - Serving clients across the US | Guiding your retirement with integrity and expertise.

Quick Contact Info

2520 Manatee Avenue West

Suite 200

Bradenton, FL 34205

info@sherrillwealth.com

941-745-2201

Site Menu

Site Menu

Our Services

Retirement Planning

Investment Management

Social Security Timing

Retirement Income

Tax Planning

Insurance Optimization

Estate and Legacy Planning

Retirement Readiness Masterclass

TO TOP

Advisory services offered through Commonwealth Financial Network®, a Registered Investment Advisor.

Information presented on this site is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any product or security.

Certified Financial Planner Board of Standards

Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification mark.

This communication is strictly intended for individuals residing in the United States.

© 2012-2024 Sherrill Wealth Management | Privacy Policy | site credits

© 2012-2024 Sherrill Wealth Management

PRIVACY POLICY | site credits